YouNet Ecommerce Intelligence (YouNet ECI) has released a report titled “Decoding the biggest Sale season of the year on Shopee and Lazada – Infant formula category” to provide milk and FMCG brands with insights into the effectiveness of Super Sale campaigns on ecommerce platforms.

Budget allocating tactic for Shopee vs. Lazada:

E-commerce data intelligence solution YouNet ECI conducted the report based on revenue data (calculated by GMV) acquired from more than 1,700 shops selling infant formula products that generated revenue on Shopee and Lazada from November 2022 to January 2023.

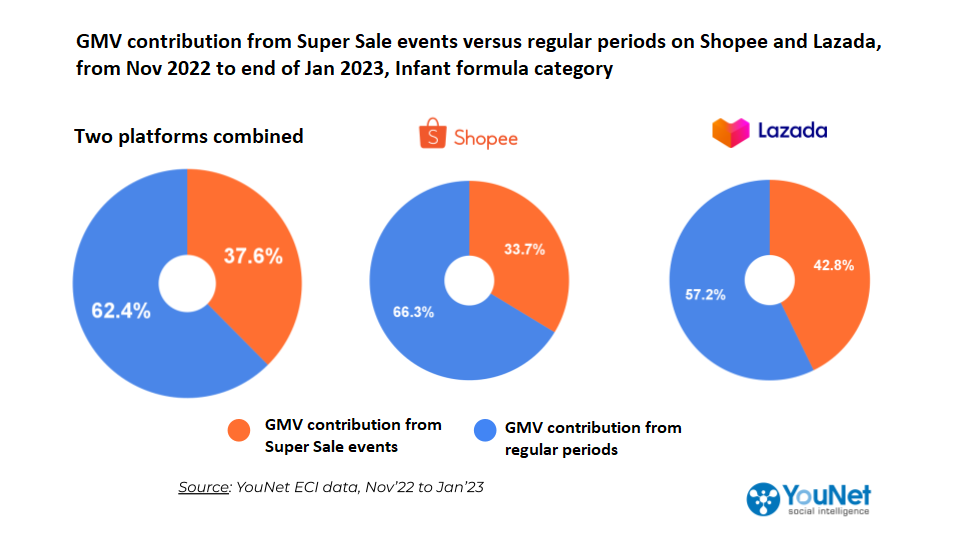

Accordingly, the infant formula category generated a total revenue of 288.8 billion VND from the two e-commerce platforms. Of which, 108.5 billion VND (37.6%) was revenue generated during the Super Sale events 11/11, 12/12, and Tết Holiday Sale 2023 on Shopee and Lazada.

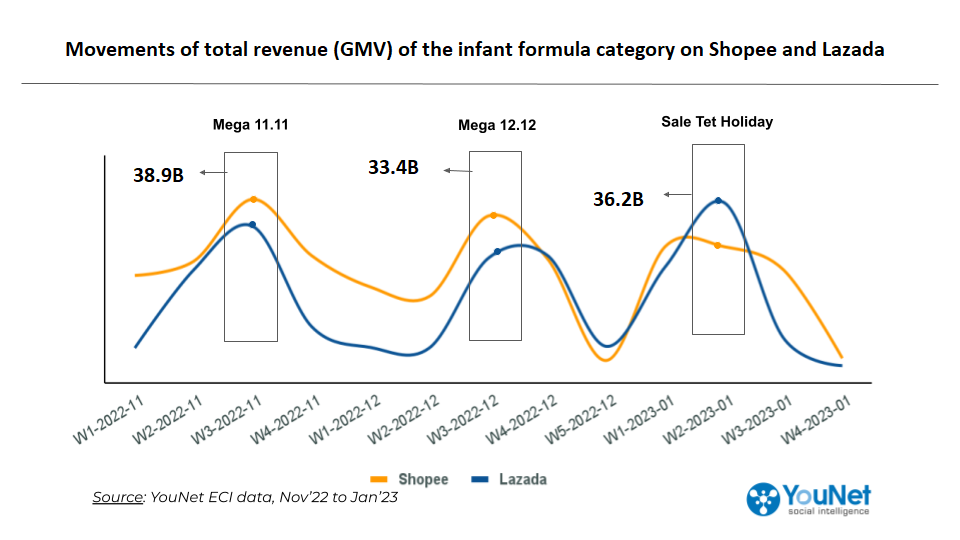

Overall, the revenue generated on the two platforms did not differ much from each other during the main Super Sale events. However, significant differences in revenue emerged during the periods following the Super Sale events.

In the weeks immediately after the main events, the total category revenue on Lazada experienced strong fluctuations, while on Shopee, the total category revenue remained relatively stable thanks to positive effects of Shopee’s mid-month sale events.

Digging deeper into the revenue structure of the two platforms, the differences become even clearer.

On Shopee, only 33.7% of the total revenue from infant formula brands during this period came from the Double Day Super Sale events. The majority of revenue, accounting for 66.3%, came from regular days or mid-month sale periods.

Therefore, for Shopee, infant formula brands should consider allocating their budget evenly across the month to maintain a consistent presence throughout the end-of-year season.

In contrast, on Lazada, as much as 42.8% of the total revenue from the infant formula category over the three months came from the Double Day Super Sale events alone.

This ratio suggests that the Double Day Super Sale events are must-win occasions on Lazada, and brands should allocate the majority of their budget to these events accordingly.

Top 10 infant formula brands during the Super Sale period:

Possessing the most accurate data intelligence on revenue for each brand on e-commerce platforms, YouNet ECI’s report reveals the top 10 best-selling infant formula brands on Shopee and Lazada from November 2022 to the end of January 2023.

Diving into the details of these top 10 leading brands, YouNet ECI discovered that all 10 of these brands have over 65% of their revenue coming from official stores on LazMall and Shopee Mall. In some high-ranking brands such as Similac, Enfagrow, GROW, Nutren, Friso, this ratio even reaches over 75%.

The online market for infant formula in the 2022 end-of-year season was dominated by strong official distribution channels of brands.

High-price segments are popular in the end-of-year shopping season:

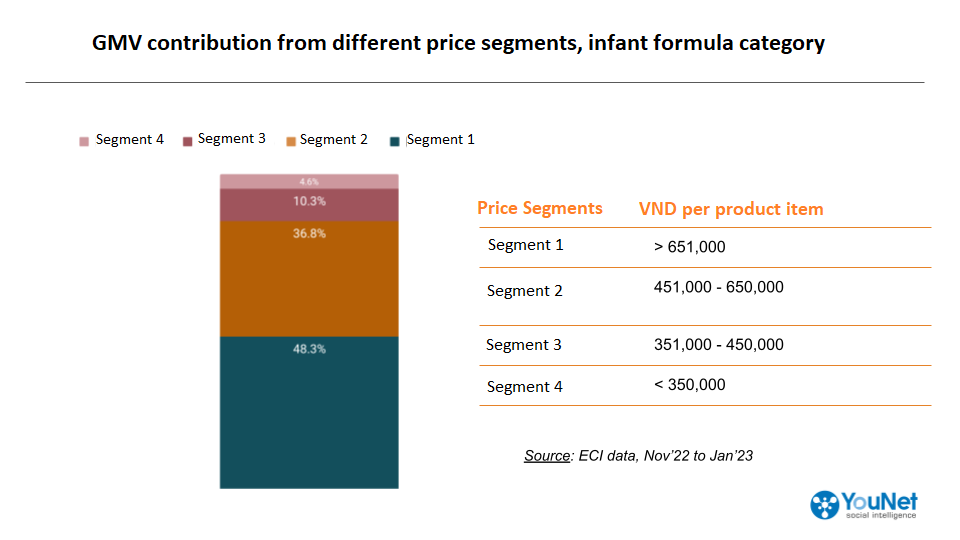

Next, YouNet ECI’s report looks for the best-selling infant formula segment, price-wise, on the shopping platforms during the end-of-year season.

Within 3 months from November 2022 to the end of January 2023, products priced at over 650,000 VND per item accounted for 48.3% of the market share on Shopee and Lazada. Following closely behind is the segment from 451,000 to 650,000 VND, accounting for 36.8% of the market share.

YouNet ECI’s data also reveals that during this time, the average selling price of infant formula products consumed on Lazada is 95,064 VND higher than that on Shopee.

This difference shows that within the infant formula category, consumers on Lazada have a larger basket size than those on Shopee. Brands need to grasp this difference to choose the appropriate product portfolio and consumer stimulus schemes for each platform.

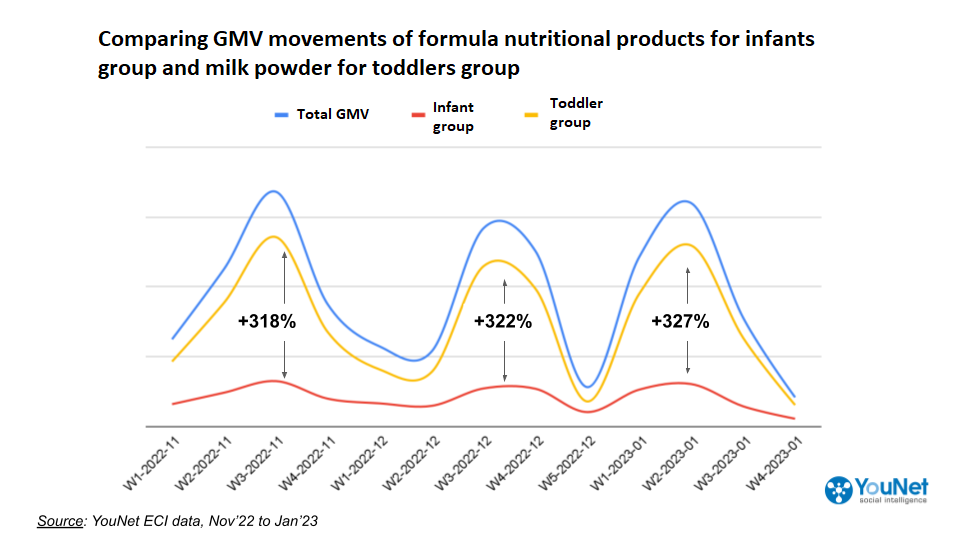

In addition to price, the infant formula category is also divided into two groups including formula nutritional products for infants (under 1 year old) and milk powder for toddlers (from 1 to 3 years old).

Data shows that the milk powder for toddlers group has significantly increased revenue during the Super Sale periods. Conversely, the formula nutritional products for infants group only slightly increased in revenue and had a lower GMV in each Super Sale period by over 300% compared to the other group.

This shows that the market share of these two product groups on e-commerce platforms is currently significantly different.

In addition, according to YouNet ECI, in order to effectively utilize Super Sale events on e-commerce platforms, brands also need to pay attention to researching and understanding the market, including aspects such as the characteristics of each event, key segments of the category, and consumer purchasing behaviors on each platform.

About YouNet Ecommerce Intelligence:

YouNet Ecommerce Intelligence (YouNet ECI) is a pioneering product and service in data intelligence for e-commerce brands in Vietnam, providing the most in-depth information.

YouNet ECI Services’ deep analysis supports brands in understanding market trends, detecting strategies to increase market share, and improving operational efficiency through our reports, including:

- Research and understanding of market trends

- Analysis of product portfolio

- Evaluation of the effectiveness of Mega campaigns

- Analysis of brand visibility on e-commerce platforms.

Sign up to receive detailed consultation and start working with us: https://www.younetgroup.com/eci-services-vi/#form